|

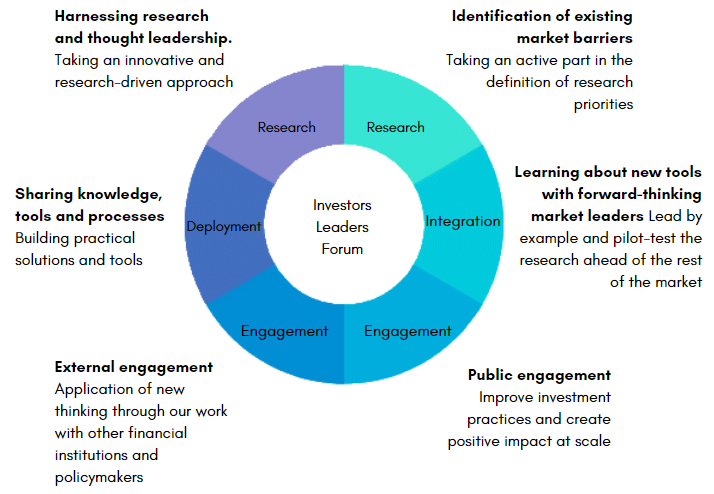

FRONTIER - The Forum for Investment Leadership

... changing investment for good The Forum for Investment Leadership (Frontier) is a global network of pension funds, insurers and asset managers, with over US$2 trillion under management and advice, committed to advancing the practice of sustainable development investment. It is a voluntary initiative, driven by its members, facilitated by the University for Sustainability and supported by academics of the University's global ecosystem. The Forum´s vision is an investment chain in which economic, social and environmental sustainability are delivered as an outcome of the investment process as investors go about generating robust, long-term returns.

Investments - and investors - must change for finance to be fit for purpose

Sustainable research or responsible investing should be an integral part of an investor’s day-to-day Whom we work with

You can’t watch the news literally anywhere without seeing giant fires and storms happening on a regular basis, There’s little doubt that something very profound appears to be going on, and it ought to be addressed.

"Smart" Money

The Forum has developed and advocated to central banks a Blockchain programmable or "Smart" money to finance green investments at scale, mitigate excessive credit creation or sudden credit contraction, and volatility in financial asset prices and exchange rates, while enabling the targeted distribution of international liquidity to the real economy.

|

FRONTIER Brochure

|

Non-Discrimination Policy*

“All human beings are born free and equal in dignity and rights." These simple but powerful words are the first line of the Universal Declaration of Human Rights adopted by the United Nations in 1949. The declaration’s power has always depended on our collective will to uphold its noble aspirations.

The University for Sustainability does not discriminate on the basis of race, color, creed, national origin, gender, sexual orientation, age, or disability in any of its policies, procedures, or practices, in compliance with Title VI of the U.S. Civil Rights Act of 1964, Title IX of the Education Amendments of 1972, Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of 1975, and Title II of the Americans with Disabilities Act of 1990. This non-discrimination policy covers admission and access to, and treatment and employment in, the University's programs and activities. The University recognizes its obligation to provide overall program accessibility for disabled persons.

Nothing in this policy shall abridge academic freedom or the University's mission. Prohibitions against discrimination and discriminatory harassment do not extend to actions, statements or written materials that are relevant and appropriately related to course subject matter or academic debate.

This policy governs the conduct of all University for Sustainability students, faculty, staff and visitors that occurs on the University’s facilities or in connection with University-sponsored programs. This policy also governs conduct by University students, faculty, staff and visitors that creates, contributes to, or continues a hostile work, educational, or living environment for a member or members of the University community.

_______________________________________________

* Approved by the Board of Directors on 10 November 2019.

“All human beings are born free and equal in dignity and rights." These simple but powerful words are the first line of the Universal Declaration of Human Rights adopted by the United Nations in 1949. The declaration’s power has always depended on our collective will to uphold its noble aspirations.

The University for Sustainability does not discriminate on the basis of race, color, creed, national origin, gender, sexual orientation, age, or disability in any of its policies, procedures, or practices, in compliance with Title VI of the U.S. Civil Rights Act of 1964, Title IX of the Education Amendments of 1972, Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of 1975, and Title II of the Americans with Disabilities Act of 1990. This non-discrimination policy covers admission and access to, and treatment and employment in, the University's programs and activities. The University recognizes its obligation to provide overall program accessibility for disabled persons.

Nothing in this policy shall abridge academic freedom or the University's mission. Prohibitions against discrimination and discriminatory harassment do not extend to actions, statements or written materials that are relevant and appropriately related to course subject matter or academic debate.

This policy governs the conduct of all University for Sustainability students, faculty, staff and visitors that occurs on the University’s facilities or in connection with University-sponsored programs. This policy also governs conduct by University students, faculty, staff and visitors that creates, contributes to, or continues a hostile work, educational, or living environment for a member or members of the University community.

_______________________________________________

* Approved by the Board of Directors on 10 November 2019.

|

© 2018 University for Sustainability The University for Sustainability is a U.S. registered 501(c)(3) tax exempt organisation All Rights Reserved. Terms of Use | Privacy Policy

|

|